The earliest Macintosh PowerBook was chunky and dark gray. It featured a built in trackball, where the touchpad is on today’s Macbook, and little rotating peg legs to elevate the keyboard at an ergonomic tilt. The screen was black and white. You could open it on your desk at school, and tuck it into its special carrying case to sling it over your shoulder when Mom came to pick you up.

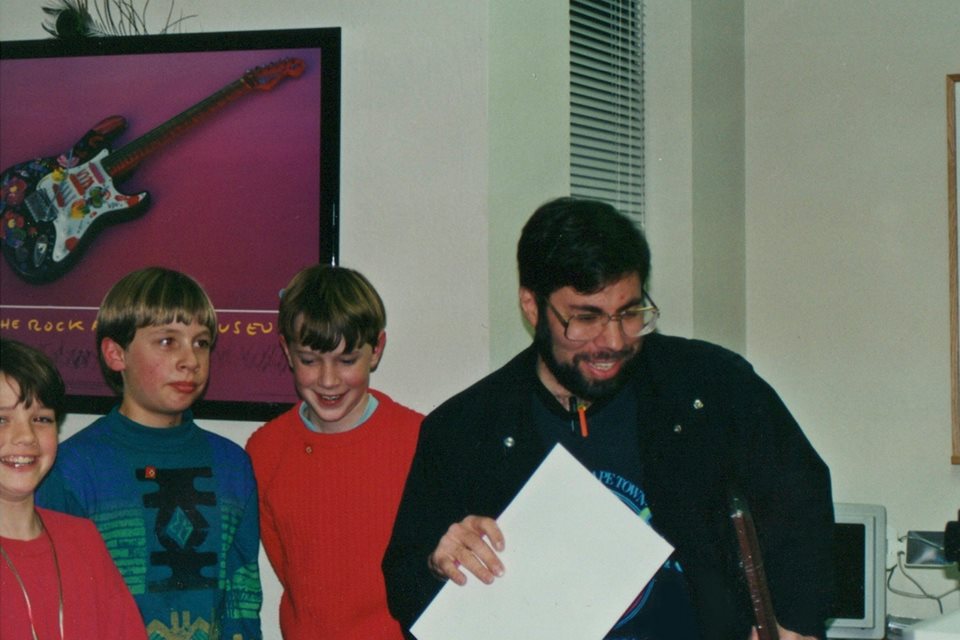

Going to school with Steve Wozniak’s kids in Los Gatos, California, meant having special access to cutting edge technology, like the Macintosh PowerBook in 1992. Along with five other students from our small school in the Santa Cruz mountains, I went to after school classes at Woz’s office to learn about Apple computers and emerging technology.

The first day, Woz taught us to dismantle and reassemble a desktop Macintosh, showing us all the pieces and what they did, with diagrams on the whiteboard. We learned the difference between random access memory (RAM) and the storage space on a hard disk, between a hard disk and a floppy disk. We learned how to navigate the innovative GUI that used windows (while PCs were still using DOS) to access the Apple utilities and adjust the settings for peak performance.

A great advocate for the intelligence and capacity of children, Woz challenged us with sophisticated knowledge and trusted us with expensive equipment, eager to see what creative uses we would put them to. He showed us the first version of Adobe Photoshop, a new technology that shook the public into doubting the integrity of photographs. Along with it, we had early model digital cameras called Canon XapShots, which used tiny floppy disks to store around 50 pictures at a time. The day he brought in America Online version 1.0, we were ecstatic that we could chat with each other from different rooms.

Woz was childlike himself, especially in his enthusiasm for developing technology. When laser pens were new, you could always find one clipped to the collar of his Hard Rock Cafe tshirt. He seemed to like them more for playing tricks on people than for any practical purpose.

Early Techs Championed by Woz Became Familiar Names

Most of the technologies Woz championed have evolved. Some went big. As dial up AOL gave way to internet browsers like Netscape, I remember sitting in our middle school’s Wozniak Library Media Center learning how to use a world wide web page called Yahoo!, the novelty of which I put to work looking up David Letterman’s recent Top 10 lists.

America Online set the original chatroom model, complete with primitive emojis. It grew so big that in 2000, the year we kids were graduating high school, it bought Time Warner for $165 billion and became AOL Time Warner, then the world’s biggest media conglomerate. Now, estranged from Time and Warner after a decade and a half of new mergers, AOL is part of the Verizon subsidiary Oath, which also owns Yahoo! and, believe it or not, Netscape, which is still around.

The success of Photoshop, of course, positioned Adobe to set industry standards, now untouchable as king of the Silicon Valley’s creativeware. Macintosh PowerBooks evolved into Macbooks. Digital photography sure became a thing. And there are exceptions, too. Those laser pens, well, occasionally you still see someone using one to disrupt their cat.

Woz on Bitcoin

Wozniak hasn’t taken his finger off the pulse of emerging tech. Still full of wonder for the promise and possibility of technological advances, he’s been outward about his enthusiasm for Bitcoin, calling it “pure digital gold,” and placing his faith ardently in its mathematical integrity.

“I believe so strongly in mathematics and purity and science as defining the world,” he told CNBC in June.

“Bitcoin is mathematically defined. There’s a certain quantity of Bitcoin,” he said, “and it’s pure. There’s no human running it. There’s no company running it, and it’s just going and going, and growing and growing, and surviving! That, to me, says something that is about—something that is natural. And nature is more important than all our human conventions.”

His journey with Bitcoin is well documented. He tried to buy some around $70, ended up not getting any until they hit $700. Then he lost a few to fraud, and when prices soared “way up in the sky,” he said he “got scared, and sold everything but one Bitcoin.”

Woz stresses that he isn’t an investor. Still a man who loves laughter, he puts a premium on happiness, not wealth, and only holds his single Bitcoin for the sake of experimentation. “Part of my happiness is not to have worries, so I sold it all — just got rid of it — except just enough to still experiment with,” he told CNBC last year.

He said he agrees with Twitter founder and Square CEO Jack Dorsey, that Bitcoin could be the first global currency. At New York’s Consensus, a blockchain conference last May, Dorsey said “the internet is going to have a native currency so let’s not wait for it to happen, let’s help it happen… I don’t know if it will be Bitcoin but I hope it will be.”

Woz responded: “I buy into what Jack Dorsey says, not that I necessarily believe it’s going to happen, but because I want it to be that way.”

By contrast, Woz has called federal fiat currency “kind of phony.”

…And on Blockchain

But Bitcoin isn’t blockchain. It’s just the first and most well known use of blockchain technology. Last month at New York’s NEX technology conference, Woz called blockchain a bubble, similar to the dotcom hype bubble of the early aughts. “It was a bubble, and I feel that way about blockchain,” he said on stage.

“Blockchain in all forms is so popular and being studied by so many people,” he previously said in June’s CNBC interview. “It may be long term. I do see it, as you said, as a bubble… There’s a huge amount of interest in it right now, but things aren’t going to change that rapidly. That’s what the internet bubble was about.”

When asked how long he expects it to take for blockchain to gain widespread traction, he referred to the lag between the dotcom bubble and today, when we’ve finally realized many of the dotcom era dreams: “I’m going to give it 10-15 years.”

Part of the reason for this is human adjustment to new technology. “People have to have their mindset change,” he said. “Culture and tradition, and status quo and the way things are doesn’t change that rapidly, instantly, when it’s that huge.”

His faith in blockchain appears to be mixed. But in a seeming contradiction, Woz has suggested Ethereum could be the next Apple. “Ethereum interests me because it can do things and because it’s a platform,” he said at a May tech conference in Vienna.

Woz’s view of Bitcoin as solid gold but blockchain as a bubble is the inverse of that held by Jack Ma, chairman of China’s Alibaba and its fintech affiliate Ant Financial. Last month Ma said that the “technology itself isn’t the bubble, but Bitcoin likely is.”

Bubble or No, the Future Still Seems to be Blockchain

Which way is it? Is Bitcoin the bubble while blockchain is solid, as Jack Ma says, or the other way around, as Woz indicates?

Woz’s hope for Bitcoin as the pure-form currency of the future could prove misplaced if demand for it suddenly falls off. Blockchain, meanwhile, has myriad potential uses in finance, logistics, travel, even the art world. Developers and entrepreneurs are testing the mettle of this new technology with fervor and abandon. If we’ve learned from the dotcom bubble not to bet all our chips on untested technology, we can watch it develop steadily, as the internet did around the turn of the century. And even if the hype around blockchain is a bubble, Woz is probably right about the technology’s ultimate staying power.

To say the least, he’s seen a lot of technologies come and go. Sometimes, like the novelty laser pens of the late 1990s, new tech is just a fun experiment. But Woz’s enthusiasm for Bitcoin and measured interest in blockchain platforms like Ethereum is an indicator. A mathematically pure ledger system that governs transactions with transparency and automation holds emergent promise for the childlike optimist in any of us, much the way the Macintosh PowerBook did in 1992.

Thanks, Brian. I’m surprised how accurately you captured me in this article. By the way, Brian was one of my first class of 6 students that went so well that I continued for 8 years with full-sized classes of 20-30 students. These classes were all in the local public schools, with no press allowed.

Thanks for reading, Steve, and for your feedback!

viagra without a doctor prescription usa

Kamagra Tablets Vivanza 20mg [url=http://leviprices.com]levitra price per pill[/url] Pharmay Cheapest Cialis 20mg No Prescription Acheter Vrai Cytotec

I’m truly enjoying the design and layout of your blog. It’s a very easy on the eyes which makes it much more enjoyable

for me to come here and visit more often. Did you hire out

a developer to create your theme? Outstanding work!

Hey I am so thrilled I found your blog page, I really found

you by error, while I was searching on Askjeeve for

something else, Anyhow I am here now and would just like to say thank you for

a incredible post and a all round enjoyable blog (I also love the theme/design), I

don’t have time to browse it all at the moment but I have

bookmarked it and also added in your RSS feeds, so when I have time I will be back to read more, Please do keep up the fantastic work.

Everyone loves what you guys tend to be up too.

This type of clever work and coverage! Keep up the excellent works

guys I’ve incorporated you guys to blogroll.

Thanks for some other excellent article. Where else

may just anybody get that type of info in such a perfect means

of writing? I’ve a presentation next week, and I’m on the search for such info.

Its like you learn my thoughts! You appear to understand so

much about this, such as you wrote the ebook in it or something.

I think that you just could do with some % to pressure the message house a bit,

but instead of that, this is wonderful blog. A fantastic read.

I’ll certainly be back.