The blockchain phone you didn’t know you needed has arrived. As phones have transformed into mobile devices they’ve absorbed tasks previously delegated to desktop computers, cameras, globes, flashlights, alarm clocks, and your Sony Walkman. Now you can add crypto wallets to the mix.

Digital Trends gave us the scoop on the Finney, the new phone by London-based mobile security specialists Sirin Labs. It includes a cold storage (fancy term for ‘offline’) wallet, a built-in token conversion service for smooth transactions, and a DApp center. They designed the phone to be the premier mobile “for crypto experts and novices alike,” according to their website.

It’s timely, as crypto is still trying to break through the membrane into mainstream adoption, and mobile could be the vehicle to make it happen. The Finney itself, though, may not make the crossover.

First, Some Tech Specs

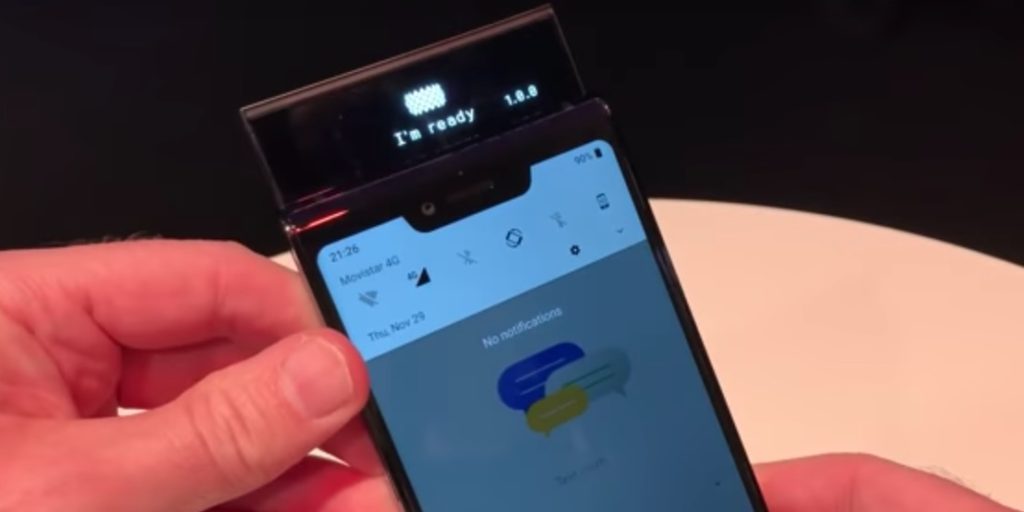

Finney’s standout feature is a second screen hidden behind the top edge of the phone. The screen is actually a separate set of hardware altogether—the cold wallet itself. When it’s tucked into place, it’s disconnected and unhackable. Only when you slide the screen open does it go live so you can execute a transaction.

The phone’s software, SirinOS, is Android 8.1 modified for security and certified by Google. It runs on a Qualcomm Snapdragon 845 processor, with 128 gigs of storage and 6 gigs of RAM. It has a body of metal and Gorilla Glass, a 12 megapixel camera on the back, along with a fingerprint sensor. The Finney also features an Intrusion Prevention System (IPS) for an added layer of security.

Having the wallet placed at the top means the camera and fingerprint scanner are lower on the phone’s body than on previous models. See for example Sirin’s first phone, the Solarin, a security-obsessed $14,000 non-blockchain luxury mobile, which came complete with Italian leather backing and had a camera and fingerprint scanner where you’d expect them. On the Finney, the fingerprint scanner is too far down for effortless use. It invites slip ups where you press the camera lens instead.

The Finney is Nice, But It Will Take More to Mainstreamize Crypto

“It makes sending, receiving and converting cryptocurrencies securely on a smartphone surprisingly easy,” says one Digital Trends review of the Finney. But they qualify that ‘easy’ is relative, and the Finney is actually more of “a niche device for those who really are invested in cryptocurrency.”

Senior Writer Andy Boxall was less impressed. “The problem is its main feature,” that is, the cold wallet, “is only compelling to those who use, understand, and believe in cryptocurrency and the Blockchain.” For those who don’t already understand the ins and outs of crypto, it won’t be much of an advantage.

“Do not expect the Finney phone to make this baffling world [of crypto] much less confusing and problematic,” says Boxall. He describes the setup process as requiring trust in a bunch of companies you’ve never heard of, as well as the navigation of unfamiliar technologies and products. And for all the effort, he says, there’s little benefit for the crypto newcomer or ordinary mobile user.

“I carried on with the process because it’s my job,” says Boxall, “but if it wasn’t, I may have given up a lot sooner.” While the Finney hits many of the marks it aims for as far as design and functionality, simplifying the crypto process for novices doesn’t seem to be coming together with this phone.

“Living with the Finney has made it very clear that cryptocurrency is not ready for mainstream use yet,” says Boxall.

Get Your Finney If You Can

Sirin first released the Finney for sale only in exchange for their native SRN token. It went on the mainstream market in January so you can now purchase it with Paypal or, if you’re Gordon Gekko, a credit card. One final and important caveat: the company ships from their UK headquarters to 143 countries, but alas, the US isn’t one of them.

If you’re looking for a way to store your crypto securely and portably, make smooth crypto transactions on the go, or inspire jealousy in your American blockchain friends, the Finney may well be worth its $1,000 price tag. If you’re a newbie who’s interested in learning the ins and outs of crypto, there are better places to start.

No matter if some one searches for his vital thing, so he/she desires

to be available that in detail, thus that thing is maintained over here.

Hi, Neat post. There’s a problem together with your web site in web explorer,

could test this? IE nonetheless is the market chief and a good component of other folks

will leave out your excellent writing due to this problem.

naturally like your web site however you have to check the spelling

on several of your posts. Several of them are rife

with spelling problems and I find it very bothersome to tell the truth however I’ll surely come again again.