On April 30, Yuga Labs minted their widely anticipated “Otherdeeds,” NFTs that represent digital real estate in the company’s metaverse game called Otherside.

The anticipated land grab was a hit. Traffic surged so much on the Ethereum blockchain during the 24-hour sale that it ultimately interrupted operations. Headlines highlighted unprecedented gas fees, which rise in conjunction with transaction volume.

In spite of the technical problems and steep transaction costs, the mint was a success. Yuga Labs generated $561 million in Otherdeeds sales and around 5500 NFTs were minted. Priced at 305 APE each, the digital parcels cost the equivalent of about $5800 at the time of the sale.

While Otherdeeds represent only one of a number of digital real estate opportunities in the metaverse, it’s a good proxy for other cryptocurrency-based digital land plays.

So, as the value of crypto decreases or stagnates, is digital real estate still valuable? And what’s the future of real estate in the metaverse?

Defining terms (feel free to skip ahead if you’re web3 fluent)

To tackle this topic, we have to define a few terms. The metaverse is a hybrid universe posited to connect our digital and physical realities. While in the strictest sense, the metaverse is still years from being realized, it can be conceptualized in the context of online video games that are becoming more and more entangled with our physical realities – from Chipotle experiences in Roblox to digital Nike sales in Fortnight.

Whether or not the metaverse comes to fruition as it has been proposed by tech behemoths like Meta (formerly Facebook) is still in question; however, it’s clear that there’s an appetite for unique experiences and merchandise in digital spaces and we’re all but certain to see rapid expansion and innovation to meet the demand.

Enter digital real estate. Brands like Yuga Labs are minting their own metaverses and selling digital land within. On this digital land, users can build and customize digital spaces. In Yuga Labs’ case, it allows users to build and interact with space in the context of the Otherside game.

Other web3 platforms, like MetaVRse, believe there’s a demand for digital land sales outside of the gaming community. The company is building a digital mall and selling space to retail tenants.

What does this have to do with crypto?

Because digital land is not a physical asset, there’s an intuitive connection between this imagined property and cryptocurrency. In Yuga Labs’ case, the land is being sold, or minted, as NFTs which form the bridge between the metaverse and the crypto community. The NFTs are transparently recorded on their respective blockchains.

The price of crypto

As cryptocurrency has experienced a rapid decline, it impacts the perceived value of the real estate since the holding is associated with the crypto (in Yuga’s case, APE).

At the time of the Otherdeeds mint, Bitcoin was at $38,469, already a far cry from its all-time high of $68,000 at the end of the previous year. Fast-forward three months and it’s declined by almost another half since and has been sitting around $20k. ETH was worth $2726 at the time of the sale and has declined by more than 51%.

APE was worth $24, compared to today’s $6.75, marking a staggering depreciation in the perceived value of Otherdeeds.

So, what are these digital lands really worth?

A case for digital land sales

Brands are interested in the metaverse because of its marketing implications. Not only can brands have a presence in the context of these virtual spaces, but they can also gamify experiences with consumers, attract younger demographics, and amass unprecedented data.

Moreover, the ability to customize spaces in online worlds is not a hard sell to gamers who are already familiar with the concept and will spend money on digital items like skins for their avatars in order to show personality and social proof.

It’s likely that these digital parcel sales will continue, as a result of the experience potential for both brands and consumers. Moreover, some digital land owners believe they’ll be able to rent or sell their holdings to earn cash.

“There seems to be a growing number of projects ‘minting’ land,” says Sami Khan, the CEO and Co-Founder of ATLAS:EARTH, an app that allows people to buy and rent digital land representing real-world spaces.

“Most investors are buying digital real estate purely based on speculation in hopes to flip the land. But our thought process is: how do we create an analog with the real world?”

Khan touts a slow and steady approach to investment in digital properties, with a horizon of eight to ten years. “Projects that focus on making virtual real estate competitive and stable relative to real world real estate opportunities will be the real winners, and the market for them is much larger,” he says.

According to Khan, the beauty of digital real estate is in the data and utility. “Virtual real estate projects will add value through tokens, traffic and eyeballs, and investors can make true ROI-based decisions on purchasing and assessing property values,” he says.

What about the tech?

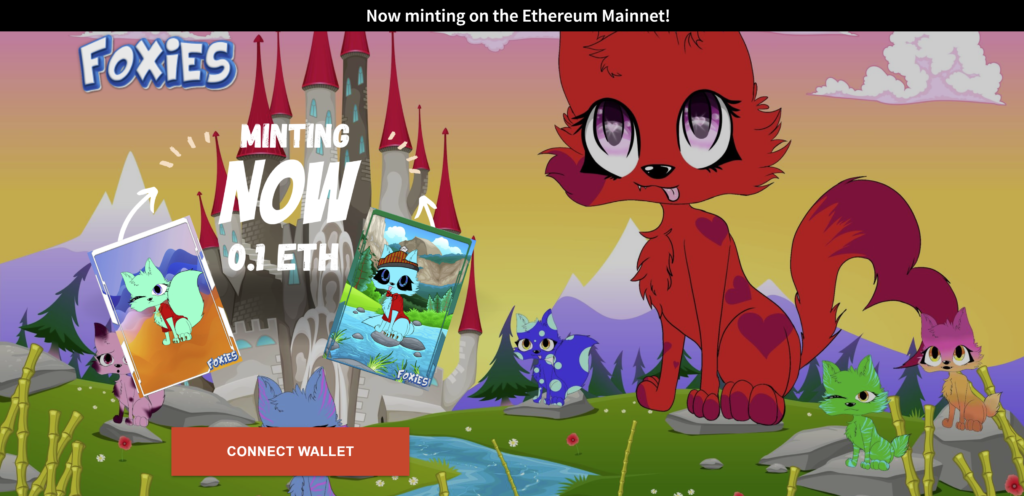

Let’s back up to the blockchain technology that enables the NFT sales. We don’t have to look much farther than Yuga Labs’ example, which took down the Ethereum mainnet, to uncover some limits in the technology.

“Quite simply, Ethereum Mainnet is not scalable as-is. This is not new news and it’s not something that can easily be stress-tested so [Yuga Labs’] only option was to pray that it didn’t implode,” says Beau Button, the President, CTO and Co-Founder of ATLAS:EARTH. “Clearly that wasn’t enough.”

Button is looking to alternative mainnets for his own technology, namely Avalanche, which he believes will overcome some of the early technical issues with NFT purchases.

“The tolerance for technical anomalies is much higher among the first generation web3 users, thankfully,” continues Button.

So, is there a case for digital real estate? Absolutely. But if you get past the digital art sales and smoke and mirrors, the real utility of NFTs are still at the mercy of the technology that backs them – and the technology has a ways to go.