The number of blockchain-related jobs posted on LinkedIn more than tripled last year, according to CryptoCoin News. And blockchain patent filings more than doubled. Companies and individuals alike are innovating, exploring the blockchain’s well of possibilities. Major fintech companies, meanwhile, are gobbling up blockchain patents like they’re going out of style. But cryptocurrencies themselves still have yet to see a mainstream embrace.

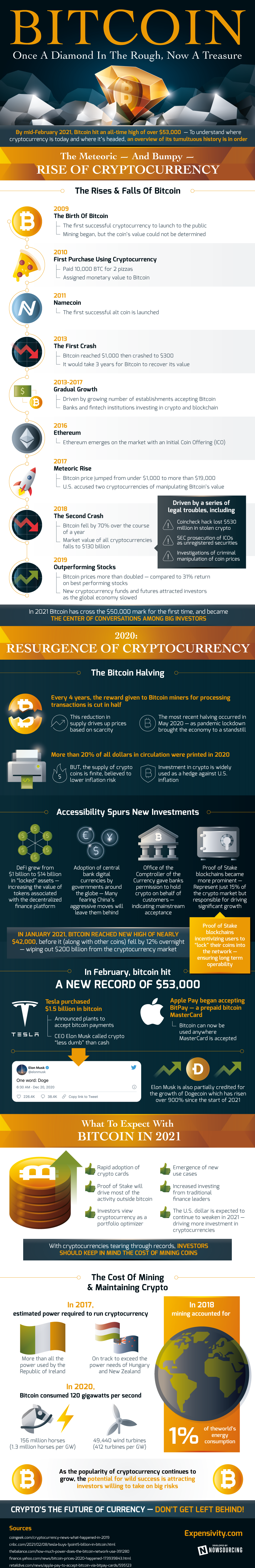

The main problem with crypto right now is the same problem people have been talking about since Satoshi Nakamoto said Let there be Bitcoin: volatility. And ever since Bitcoin’s dramatic rise and fall around the turn of last year, cryptos have become virtually synonymous with wild fluctuations.

This reputation has given Bitcoin specifically, and cryptos in general, a mixed reputation. By now we’ve all heard the songs of praises from evangelists and the sour sneers of financial titans alike. Crypto is exciting because it’s unstable; crypto is unrealistic for the same reason.

The Primary Criticism of Cryptos

According to Eric Lamison-White, founder of the investor’s crypto intel platform Pareto Network, volatility is the “primary criticism of cryptocurrencies.”

But he doesn’t think it has to be that way. What if you could stabilize your crypto accounts? Lamison-White says the risks of owning cryptos are “easily mitigated by a variety of hedging techniques that are available in all other asset classes.”

He proposes treating crypto accounts like more traditional assets. “Hedging with options, futures and swaps allow for stable value or any risk profile that an owner or even a speculator would desire.”

That’s the idea behind his patent, filed in 2014, for a structure of interconnected accounts. The system “removes volatility from owning cryptocurrencies,” Lamison-White says, transferring its fluctuations into a hedge account. Here’s how it works.

Lamison-White’s System

The system requires at least two accounts: one for your cryptos and one you’ve funded with fiat currency, let’s say $400 US dollars. These accounts connect to a network of decentralized nodes, which measure the amount of cryptocurrency you have from moment to moment. If there’s any drop in the crypto’s value, the system automatically deducts from your $400 in the other account and transfers it to compensate. When the value of your crypto goes back up, the system re-deposits back into your fiat account.

This holds the value of your crypto assets steady, while transferring its volatility to your hedge account.

What makes it unique compared to other trading systems is that crypto assets can be divided into infinitely small portions. “A futures contract on oil costs $80,000 for example, although a trader only needs to put up maybe $4,000 as a minimum,” Lamison-White says. “This is because the contract represents the price of 1,000 barrels of oil or something crazy.” He notes that even hedging stocks are usually offered in units of 100 or 1,000.

Not so with crypto, where the “infinite divisibility of the asset itself” makes hedging much more finely tuned. Because cryptos are pure math instead of physical assets, “arbitrary sized contracts can be traded just as easily with larger contracts.” One future could represent one bitcoin, for example, but you can also trade in .01 increments. With fractional futures and options, people with very small amounts of cryptocurrency can be shielded from price fluctuations in a way that had only been available to the wealthiest and investment banks for most of the last millennia.

The System at Scale

The system gets even more interesting when you make it scalable. According to Lamison-White, you could have multiple people funding and connecting to the same hedge account, each using it to stabilize their own crypto accounts. Alternatively, you could connect multiple hedge accounts to a single crypto account. Suddenly the possibilities extrapolate, like tinkertoys, developing into an interconnected network of crypto- and fiat-funded accounts, with a variety of owners controlling their assets at a variety of access points, everything regulated with the intelligence and transparency of a decentralized ledger.

Patents Like This are Attracting Corporate Giants

There’s a feeding frenzy going on for patents like these. Visa filed a patent for a B2B blockchain payment system, Mastercard developed its own blockchain patent for anonymous transactions, and Wal-Mart has come out with a few as well. But it’s Bank of America that’s gobbling up the most. With claims to at least 43 live blockchain patents, the financial giant holds more than any other person or company.

Whether they’re just trying to get a leg up on the future of tech, or positioning themselves to harangue the little guy with barrages of lawsuits for intellectual property rights, we’ll just have to wait and see.

Whether or not Lamison-White anticipated the blockchain patent arms race, he was ahead of the curve, filing for his patent in 2014. It could be the thing to finally put skeptical minds to rest about the viability of crypto assets. And with big financial institutions like Bank of America placing a premium on innovative blockchain patents, he may have spun ether into gold.

Wow that was strange. I just wrote an really

long comment but after I clicked submit my comment didn’t appear.

Grrrr… well I’m not writing all that over again. Anyway,

just wanted to say fantastic blog!

If you are going for most excellent contents like I do, only pay a visit this site daily because it presents quality contents, thanks

Hi! I could have sworn I’ve been to this website

before but after checking through some of the post I realized it’s new to me.

Anyways, I’m definitely happy I found it and I’ll be book-marking

and checking back often!

This website was… how do you say it? Relevant!!

Finally I’ve found something that helped me.

Kudos!

Its like you read my mind! You seem to know a lot about this, like

you wrote the book in it or something. I think that

you can do with a few pics to drive the message home a bit,

but other than that, this is fantastic blog.

A great read. I will certainly be back.