International art dealer Christie’s has announced they’ll be tracking art transactions and storing encrypted registrations on the blockchain. The 250 year old London based auction house is keeping things interesting by partnering with Artory, a blockchain registry for the art market.

This November, Christie’s will unveil An American Place: The Barney A. Ebsworth Collection at their Rockefeller Center showroom in New York. The collection includes work from modern American masters such as Georgia O’Keefe, Jasper Johns, Willem de Kooning, Jackson Pollock, and Edward Hopper.

Christie’s estimates the value of the collection over $300 million. Every sale from the auction will include an encrypted certificate of sale, via Artory, and a permanent record of the transaction chiseled in block. Christie’s expects this to be a major boon to collectors and investors.

“Our pilot collaboration with Artory is a first among the major global auction houses, and reflects growing interest within our industry to explore the benefits of secure digital registry via blockchain technology,” Says Christie’s CIO Richard Entrup. He calls the upcoming auction “an ideal platform for our clients to experience this technology for themselves and to explore the advantages of having a secure encrypted record of information about their purchased artwork.”

Artory CEO Nanne Dekking adds that they’re “delighted to work with Christie’s on this industry-leading collaboration”, and pleased to be able “to show the art world how digital encryption technology can benefit buyers and collectors in the future.”

The Blockchain Has Unique Benefits For Art Dealers and Collectors

It isn’t the first time we’ve seen art for sale on the blockchain. DADA.nyc is a blockchain-only dealer for digital-only arts. They create scarcity by limiting the number of editions of digital works, and using the blockchain for proof of that scarcity and authentication of the work’s origin and ownership.

A Singapore startup called Maecenas had the idea of “fractionalizing” artworks into shares which can be bought and sold on a distributed ledger. You could, for example, own 6 percent of a Warhol. Your money goes to the gallery or individual that owns controlling shares, and your investment appreciates along with the piece.

Verisart is a blockchain system for creating secure digital certificates and detailed, “tamper-proof” records for art and collectibles. Systems like these promise to solve some of the art world’s oldest problems: forgery, devaluation, theft, and the difficulties inherent in proof of ownership and transaction histories when relying on a paper trail.

With art transactions inscribed into the blockchain, prospective buyers can verify the piece’s authenticity, and can see the history of the artwork and its valuation, without encountering any personal details about previous buyers and sellers.

The First Major Collection to Be Auctioned on the Block

This is the first time a major art dealer will sell a collection using a blockchain platform. Prior to the November auction, a portion of the show is touring the west coast, with showings in San Francisco October 16th-20th, and in Los Angeles October 23rd-27th.

Barney A. Ebsworth, the late modern art enthusiast whose collection will be auctioned at Christie’s, was an American entrepreneur and venture capitalist. Art News listed Ebsworth among the World’s 200 Greatest Collectors, and Art & Antiques called him one of America’s Top 100 Collectors.

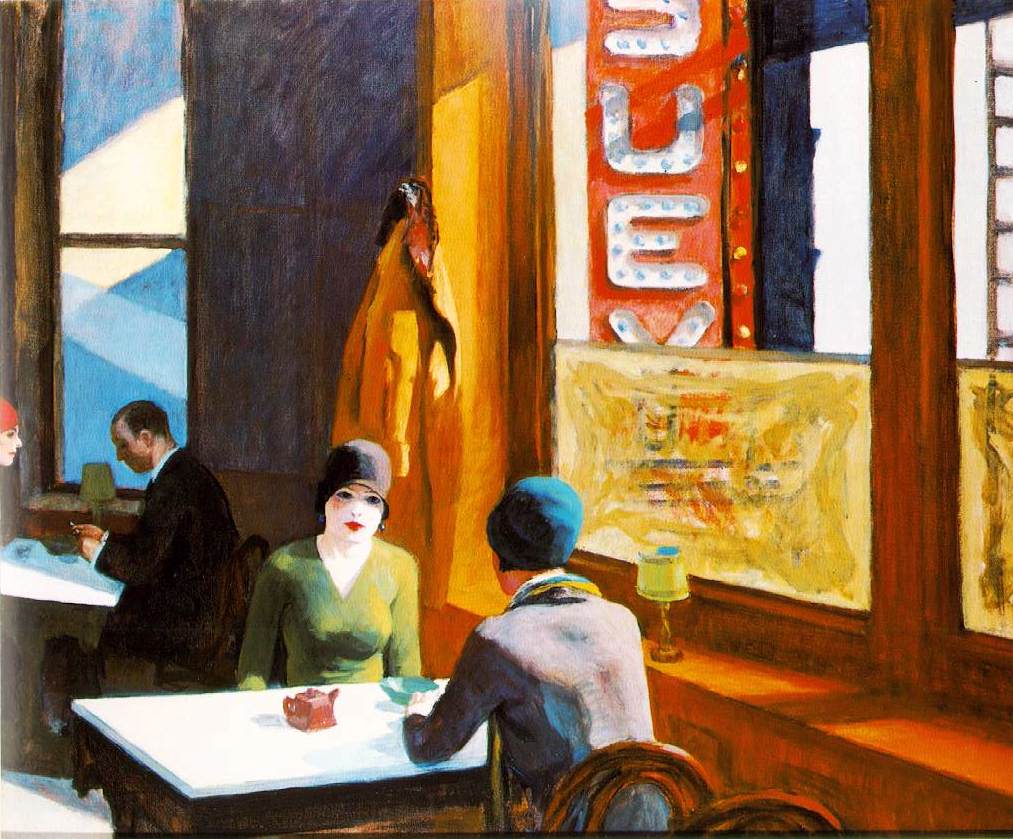

His home outside of Seattle was designed by award winning architect Jim Olson with the express purpose of housing the art collection. It included a den built around the 1929 Hopper masterpiece Chop Suey, “where Ebsworth wanted to see it as he read his morning paper.”

Chop Suey (pictured above) is one of the last Hopper paintings in the hands of a private collector. According to Artlyst, Ebsworth promised the painting to the Seattle Art Museum, where he was a member of the board. But his family has decided to sell it instead. The painting is estimated to fetch around $70 million.

Christie’s Continues to Pursue a Tech-Forward Reputation

Just halfway into 2018, Christie’s had already sold $4.04 billion in artwork and collectibles. They hold 350 auctions per year, selling artworks ranging from the hundreds to the hundreds of millions of dollars. While these sales primarily take place at their 10 showrooms, in New York, Geneva, London, Hong Kong, Milan, Dubai, Paris, Amsterdam, Zürich, and Shanghai, Christie’s previously explored online-only sales with the auction of Elizabeth Taylor’s collection following her death in 2011.

Other major dealers, like Sotheby’s, are no strangers to the value that blockchain can bring to their industry. If other art dealers follow suit with auctions on distributed ledgers, there could soon be widespread implementation of the blockchain’s trademark security and transparency for the benefit of the art world.

Thank you for every other informative web site. The place else may I am getting that type of info written in such a perfect means?

I have a undertaking that I am just now running

on, and I have been on the look out for such info.

I have read some just right stuff here. Certainly price bookmarking for

revisiting. I wonder how much attempt you place to make this sort of great informative web site.

Excellent goods from you, man. I have be aware your stuff prior

to and you are just too fantastic. I really

like what you have got right here, really like what you are stating and

the way in which through which you assert it.

You make it entertaining and you still take care of to keep it wise.

I can’t wait to learn much more from you.

This is really a terrific website.

Pretty! This has been a really wonderful article.

Many thanks for providing these details.

I’m really enjoying the design and layout of your website.

It’s a very easy on the eyes which makes it much more pleasant for me

to come here and visit more often. Did you hire out a developer to create

your theme? Exceptional work!